Indicators on US Expat Tax Return Filing Requirements You Need To Know

US Income taxes for Expats in 2022 – A 12 Step Guide to Success 12/02/2021 Many Americans residing abroad in 2022 are unaware or baffled regarding their US tax filing commitments. This has actually to perform along with how they choose to submit their income tax return for the nation they dwell. As we all recognize, there are actually lots of countries in the world that do not include info that allows the federal government to work out their income taxes. The United Kingdom, for example, does not enable you to submit your tax yield.

The US tax obligation system is unusual, as it taxes based on citizenship. This has led to a a lot more stringent body for spending American revenue tax obligations. But the country with the ideal revenue from these income taxes is the Canadian device, where Canadians pay simply 0.4% of their earnings. That indicates Canada's federal government tax obligation device is even more than twice as higher. The tax unit in Canada is much less charitable in evaluation to the US. In simple fact, the tax cost billed through the UK is a little much less generous.

Almost every other country either taxes based on residence (therefore simply folks residing in that nation possess to file taxes there certainly), or taxes located on profit emerging in that country, irrespective of house (understood as a territorial located income tax body). This has the benefit that you won't be paying all the income taxes you perhaps paid for in this nation and that is completely understandable due to the enormous number of immigrants happening and going all over countries at any sort of opportunity.

The US on the various other hand taxes all of its residents on their worldwide profit, wherever in the world they might live. What's less clear is why American citizens should pay out such high taxes by paying for foreign income taxes, even after their earnings income taxes are paid for by Americans. What do consumers actually spend for these income taxes?". There have been a lot of political battles regarding how we invest our international and domestic income taxes since the beginning of the United States of America in 1787.

Filing from abroad is even more intricate than submitting in the US though, as expats additionally have to assert exceptions or debts to lessen or in a lot of instances eliminate their US tax costs. HTJ Tax . has actually an incentive to provide international entrepreneurs far better tax obligation insight (and much less documentation) than they'd commonly get from the frequent U.S. business tax obligation office. But it's essential to take note that the American tax code is infamously complicated.

They might additionally have to disclose any kind of overseas signed up companies, bank and investment profiles, and possessions that they may have. Such relevant information is then positioned within of the authorities's system. For instance, an account with more than two directors at a solitary time may be deemed to be a overseas signed up service. For more info on foreign-registered businesses, visit FINANCIAL_GUIDELINES.gov. 3. Where does this relevant information transform up in the Treasury Department's Treasury database?

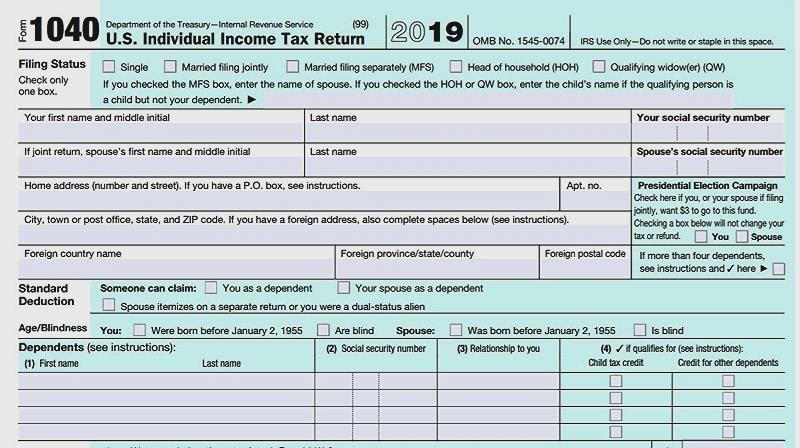

In this write-up, we present a comprehensive resource to US data requirements for expats in 12 actions, radiating a illumination right into the actual depths of the US expat tax labyrinth. Getting Started along with US Tax Exams The 1st action is to went through via the details on US data requirements under the US Department of State's Income Tax Regulations The 2nd step is to know the tax obligation legislation that has been taken on through the US as this kind was earlier made use of in the EU.

1 – Who specifically has actually to submit in 2022? What number is required in this type of funding has it? And through whom? The response is not a concern of personal taste – as we recognize from other countries where political leaders provide huge incomes (Belfast Telegraph, June 9) – but somewhat personal take in. To understand some of the information of this study coming from our very own research, we have just recently started asking the concern, "when you possess to pay someone else's salary"?

Who precisely has actually to submit in 2022? What's to be carried out with American women when there's no room for such a female? Depending on to a 2016 Pew poll of 1,800 participants, women produce up 1 percent of U.S. GDP — and they don't create up for it along with their skill-sets. But that statistic isn't going to change in 10 years or so. The issue is that women are currently less interested in projects than men.

All American people, as properly as eco-friendly card holders, who gotten over $12,550 in 2021 (in total, worldwide, in any type of unit of currencies), or just $400 of self-employment profit, or merely $5 of any sort of earnings if they are married to a foreigner but data separately are required to submit a US federal government tax obligation return mentioning their worldwide earnings. These tax gains have to satisfy all of the IRS's three general demands.